idaho estate tax return

Fiduciary - An automatic six-month extension of time to file is granted until 6 months after the original due date of the return. For more details on Idaho estate tax requirements for deaths before Jan.

It takes about three weeks to enter new filers into our system.

. Enter the total of Idaho distributable income from Form PTE-12 columns b c and e. Single under age 65. 063 average property tax rate.

Our Identity Theft page lists what to do about your taxes if you think youve been targeted. Extensions To receive an automatic six-month extension the taxpayer needs to pay either an estimate of 80 percent of the current year tax liability or 100 percent of what the taxpayer paid for state income taxes the previous yearIf the taxpayer needs to make a. The Idaho tax filing and tax payment deadline is April 18 2022.

Idaho residents must file if their gross income for 2021 is at least. Letter to Idaho State Tax Commission transmitting Tentative Idaho 345 Transfer and Inheritance Tax Return 29. An estates tax ID number is called an employer identification number or EIN and comes in the format 12-345678X.

Enter the total gross estate from line 1 page 1 of the Federal Form 706. You can prepare and e-file your IRS and Idaho State Tax Return eg resident nonresident or part-year resident returns now. Respond rapidly for faster refund.

Include Form PTE-12 with the return if the trust or estate files as a pass-through entity. Form 40 is the Idaho income tax return for Idaho residents. Line 5 Income Distribution Deduction Enter the amount of the deduction for distributions to beneficiaries.

Our Income Tax Hub page lists all our income tax resources. Sarah FisherMar 03 2020. Before filing Form 1041 you will need to obtain a tax ID number for the estate.

Instructions are in a separate file. 1 2005 contact us in the Boise area at 208 334-7660 or toll free at 800 972-7660. Idaho State Tax Commission Estate Tax PO Box 36 Boise ID 83722-0410 1.

You can apply online for this number. Idaho has no gift tax or inheritance tax and its estate tax expired in 2004. 7 rows Idaho might require an Idaho individual income tax return Form 40 or Form 43 for the last.

Single age 65 or older. Visit our refund status page to get the most up-to-date information on your 2021 tax returnThe refund status graphic tracks a returns progress through four stages. Using tax software for free tax year 2021 The State of Idaho has partnered with the IRS and certain tax software companies to allow qualifying taxpayers to prepare their federal and Idaho returns for free.

The decedent and their estate are separate taxable entities. This is especially true if the beneficiary lives in a state which has an income tax. Idaho has no state inheritance or estate tax.

Check below to see if you qualify. The final Idaho return for the trust or estate. Line 5 Income Distribution Deduction Enter the amount of the deduction for distributions to beneficiaries.

Last full review of page. However like all other states it has its own inheritance laws including the ones that cover what happens if the decedent dies without a valid will. Page last updated May 21 2019.

Please contact the Estate Tax Section Illinois Attorney Generals Office with any questions or problems. - flyer for Idaho taxpayers 12-19-2019. It has offices in the capital Boise and throughout Idaho.

Wheres My Refund video. Do not enter the total. Find IRS or Federal Tax Return deadline details.

The North Dakota estate tax is a pickup tax based upon the credit for state death taxes as computed on the federal estate tax return. Idaho Estate Tax ReturnThis means that we dont yet have the updated form for the current tax yearplease check this page regularly as we will post the updated form as soon as it is released by the idaho state tax commission. A federal estate income tax return IRS Form 1041 for income received by the estate may be required for each year in which the gross income exceeds a certain level.

Due Date Individual Returns April 15 or same as IRS. A full copy of the federal estate tax return form 706 must be filed with this return. Then click a provider to view and use the software.

Be aware that the IRS and the respective State Tax Agencies require you to e-file a Federal Income Tax Return at the same time you e. If you have general tax questions email the agency at taxreptaxidahogov or call 1-208-334-7660 in the Boise area or 1-800-972-7660. Idaho resident estate or trust is constitutionally questionable.

IDAHO ADMINISTRATIVE CODE IDAPA 350104 - Idaho Estate Transfer State Tax Commission Tax Administrative Rules Page 4 IAC 2011 01. Two the Personal Representative or Trustee may be able to convince the nonfiling nonresident beneficiary to file an Idaho income tax return. It is one of 38 states in the country that does not levy a tax on estates.

A copy of any filing by the estate that establishes changes or amends the estates federal tax liability shall be filed no later than sixty 60 days after the document is filed with the Internal. An Idaho return Form 66 for income received by the estate may also be required for each year for which a federal return is filed. Married filing separately.

The information from the federal estate tax return must be used to complete the state estate tax return. The Idaho State Tax Commission is the government agency responsible for collecting individual income taxes. Letter to Internal Revenue Service transmitting Federal Fiduciary 348 Income Tax Return 32.

If the Idaho Fiduciary Income Tax Return Form 66 is filed within the automatic extension period but less than 80 of the current year tax liability or 100 of the total tax paid last year was paid by the original due date an extension penalty will apply. Letter to Internal Revenue Service transmitting Federal Estate 346 Tax Return 30. Letter to IRS requesting prompt audit of estate tax return 347 31.

The final Idaho return for the trust or estate. For more details on Idaho estate tax requirements for deaths before Jan. Include Form PTE-12 with the return if the trust or estate files as a pass-through entity.

General Tax Return Information. We have several resources to help you protect your identity. If the estate is complicated at all you.

100 West Randolph Street. Track refund progress 247. Idaho has no gift tax or inheritance tax and its estate tax expired in 2004.

They can also e-file both returns for free. This article goes over topics that include probate how to successfully create a valid will in Idaho and what happens to your property if. Enter the total of Idaho distributable income from Form PTE-12 columns b c and e.

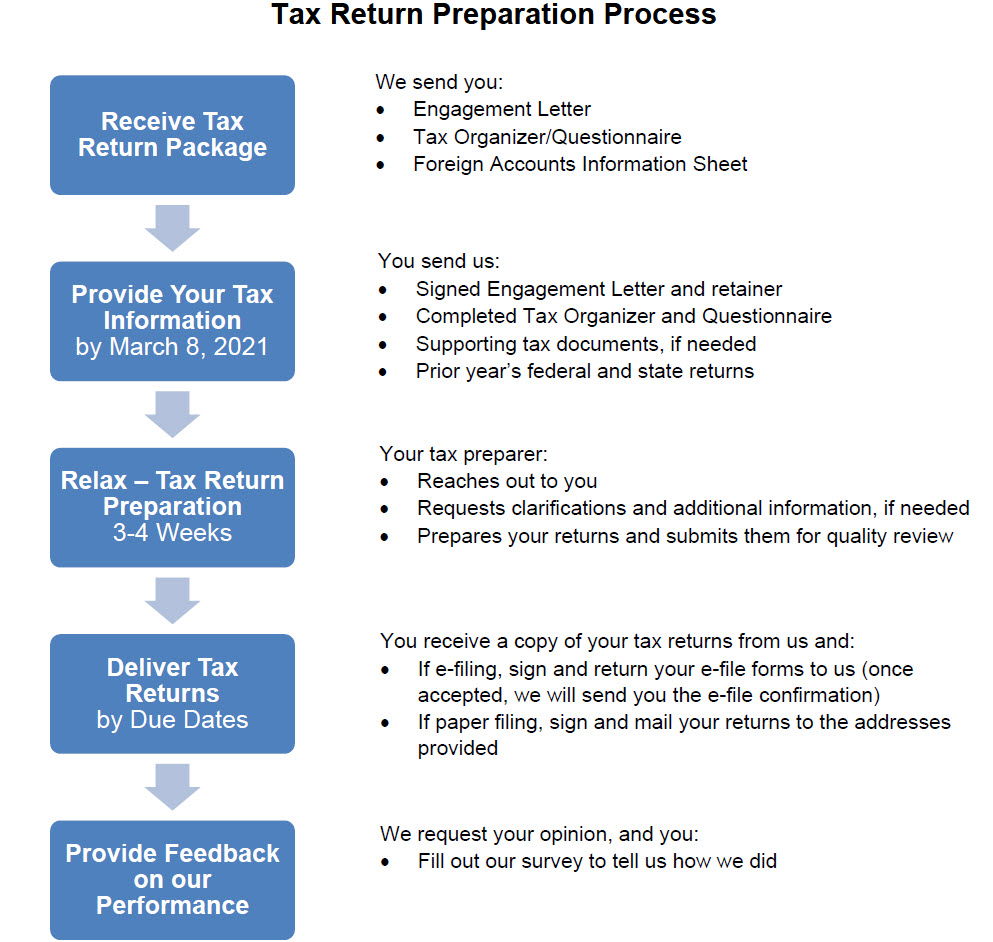

How Your Idaho Income Tax Refund Can Process Faster Tax Refund Tax Help Income Tax

Tax Form Filling Thetax Form Standard Us Income Tax Return Ad Filling Form Tax Thetax Return Ad Tax Forms Home Equity Debt Consolidation

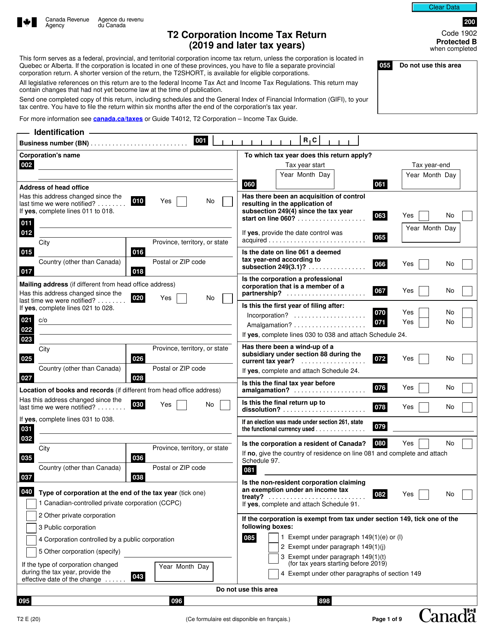

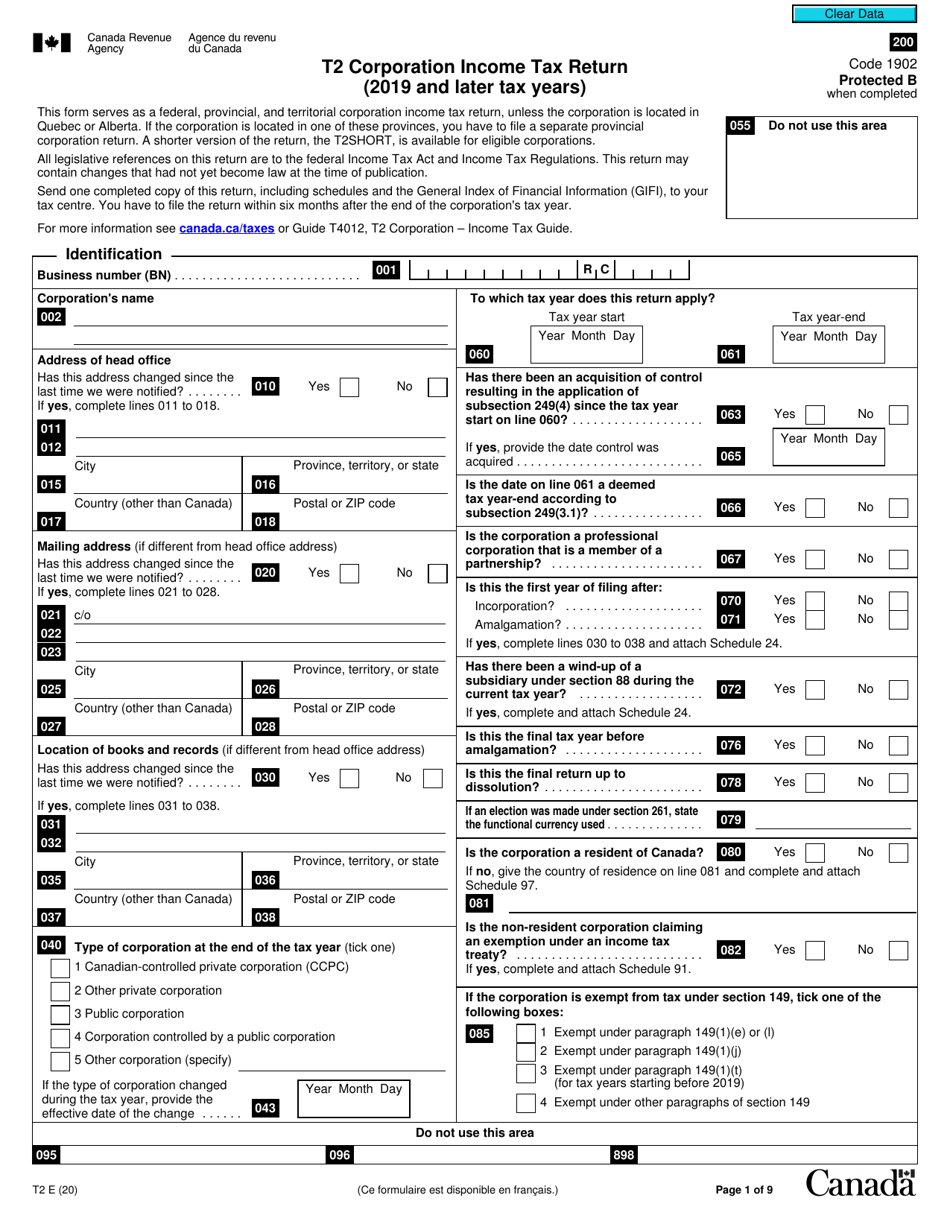

Form T2 Download Fillable Pdf Or Fill Online Corporation Income Tax Return Canada Templateroller

Form T2 Download Fillable Pdf Or Fill Online Corporation Income Tax Return Canada Templateroller

Tax Rebate Coming To Idahoans This Summer Boise State Public Radio

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

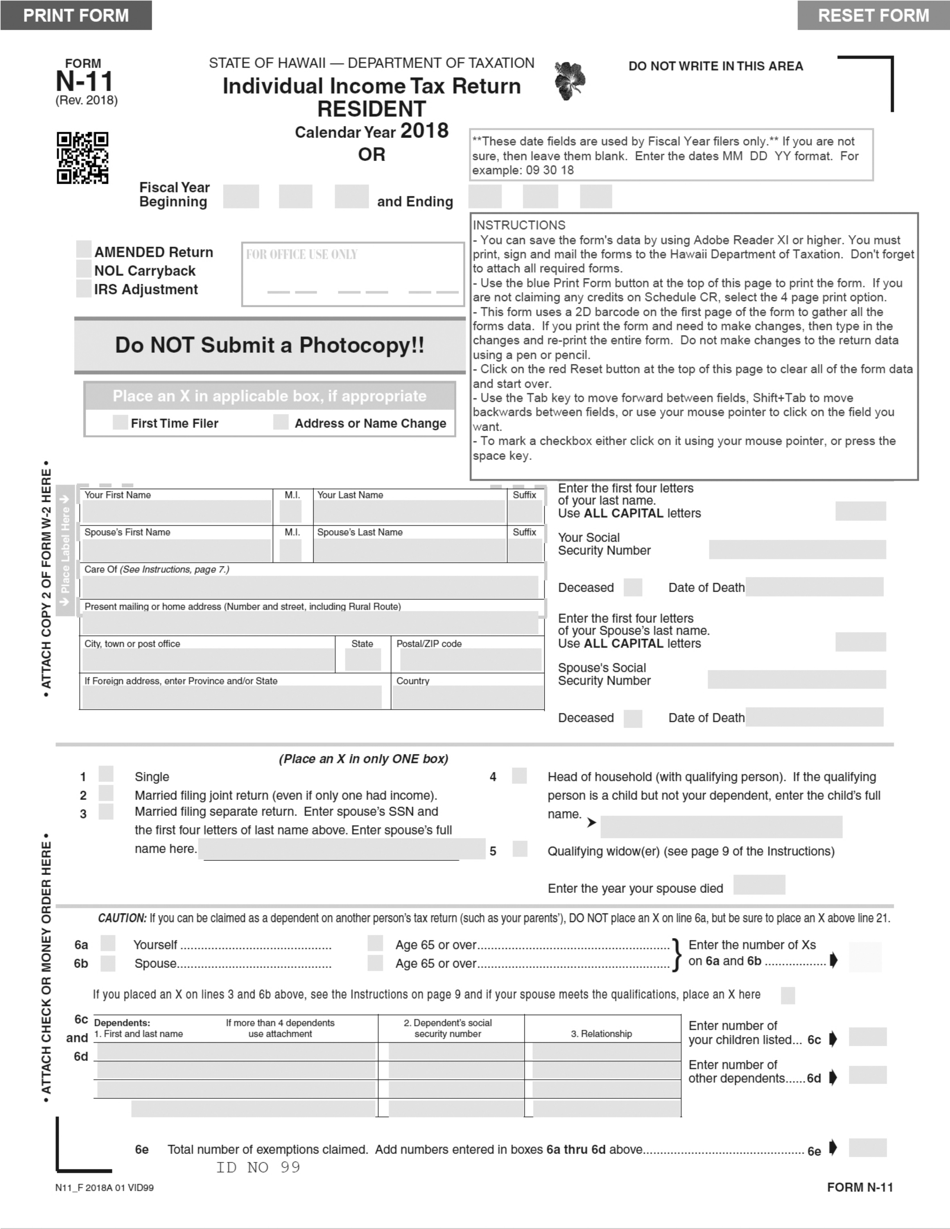

Form N 11 Download Fillable Pdf Or Fill Online Individual Income Tax Return Resident 2018 Hawaii Templateroller

How To File Taxes For Free In 2022 Money

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Understanding The 1065 Form Scalefactor

Banking Suvidha Income Tax Return Itr Pan Aadhaar Tax Saving F Personal Injury Lawyer Injury Lawyer Estate Planning Attorney

Form T2 Download Fillable Pdf Or Fill Online Corporation Income Tax Return Canada Templateroller

Deducting Property Taxes H R Block

Tax Memo Is Sugar Baby Income Taxable Chris Whalen Cpa

Tax Refunds In America And Their Financial Cost 2020 Edition Smartasset